Welcome to Paramount Property Tax Appeal, your trusted partner in navigating the complex world of property taxes. We specialize in assisting high-end homeowners and commercial property investors in California, helping them reduce their property taxes by appealing their assessments.

In this article, we will delve into a critical aspect of property taxation that often confuses many property owners - Supplemental Notices and Bills.

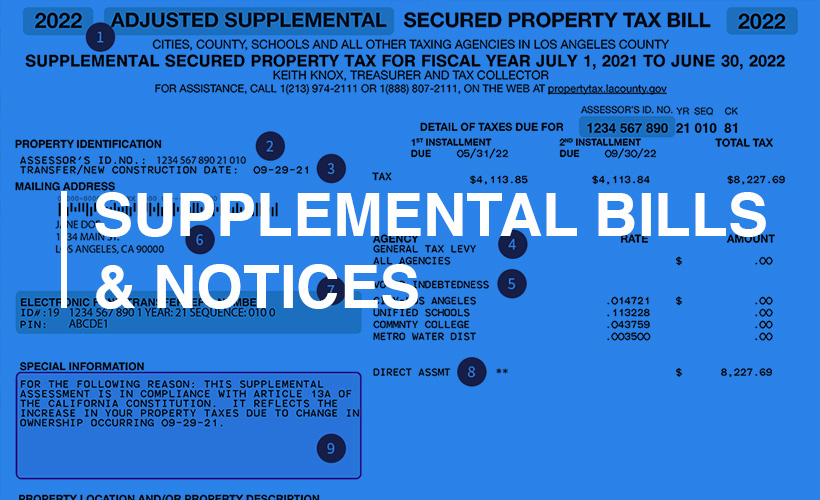

Understanding Supplemental Notices and Tax Bills

Supplemental Notices and Bills are unique to California's property tax system. They are additional tax bills that property owners receive outside of the regular annual tax bill. But what exactly are they, and why are they issued?

A Supplemental Notice or Bill is issued when there is a change in ownership or new construction on a property. This could be due to buying a new property, adding a room to your house, or building a new structure on your land. These changes can increase the assessed value of your property, leading to a higher property tax bill.

In California, the county assessor's office is responsible for assessing the value of properties. When a property changes hands or undergoes significant improvements, the assessor recalculates its value based on the current market conditions. This new assessment is then reflected in a Supplemental Notice or Bill, which is sent to the property owner.

The Supplemental Notice or Bill is separate from your regular annual property tax bill and is due in addition to it. It's important to understand that this is not a correction or a mistake, but a reflection of the increased value of your property due to the changes made.

What to Do When You Receive a Supplemental Notice or Bill

Receiving a Supplemental Tax Bill can be a surprise, but it's crucial not to ignore it. Here are the immediate steps you should take:

- Review the Notice or Bill: Carefully read through the document to understand why it was issued. Check the details of the property assessment, including the new assessed value and the reason for the reassessment.

- Verify the Accuracy: Errors can occur in property assessments. Ensure that the changes noted (such as new construction or change in ownership) actually took place and that the new assessed value aligns with the current market value of similar properties in your area.

- Contact Paramount Property Tax Appeal: If you believe that your property has been over-assessed or if you're unsure about the accuracy of the assessment, reach out to us. Our team of experts will review your case and guide you on the next steps.

The Appeal Process

In California, property owners have the right to appeal their property tax assessments if they believe they are incorrect. Here's a brief overview of the process:

- Filing an Appeal: You have 60 days from the date of the Supplemental Notice or Bill to file an appeal with your county's Assessment Appeals Board. The appeal must include a statement explaining why you believe the assessment is incorrect.

- Hearing: Once your appeal is filed, a hearing will be scheduled where you can present evidence to support your case. This could include recent sales of comparable properties, appraisal reports, or other relevant information.

- Decision: After the hearing, the Assessment Appeals Board will make a decision. If your appeal is successful, your property's assessed value will be adjusted, and your property taxes will be reduced accordingly.

At Paramount Property Tax Appeal, we understand that the appeal process can be complex and time-consuming. That's why we're here to help. Our team of experienced professionals will guide you through the process, from reviewing your Supplemental Notice or Bill to representing you at the appeal hearing. We're committed to ensuring that you pay only your fair share of property taxes.

Benefits of Appealing Property Taxes

Appealing your property taxes can lead to significant savings. By ensuring that your property is assessed accurately, you can avoid paying more than your fair share in taxes. This is especially beneficial for commercial real estate investors, where even a small percentage reduction in property taxes can translate into substantial savings given the high value of commercial properties.

At Paramount Property Tax Appeal, we've helped numerous clients successfully appeal their property taxes.

You can see what we have done for just a few of our clients in our success stories section.

We work off of contingency and offer free consultation. If you would like to see what we can do for you or if you would like us to help you with your supplemental bill/notice feel free to fill out the form below.

Conclusion

Understanding and acting upon Supplemental Notices and Bills is crucial for property owners in California. These notices reflect changes in your property's assessed value and directly impact your property taxes. By reviewing these notices carefully and appealing when necessary, you can ensure that your property taxes are fair and accurate.

At Paramount Property Tax Appeal, we're here to assist you in this process. Our team of experts will review your Supplemental Notices and Bills, help you understand their implications, and guide you through the appeal process if necessary. Contact us today to ensure you're not overpaying on your property taxes.

FAQs

Q: What is a Supplemental Notice or Bill?

A: A Supplemental Notice or Bill is an additional tax bill issued when there's a change in ownership or new construction on a property in California. This is separate from the regular annual property tax bill.

Q: What should I do if I receive a Supplemental Notice or Bill?

A: Review the notice carefully, verify its accuracy, and contact Paramount Property Tax Appeal if you believe your property has been over-assessed or if you're unsure about the assessment.

Q: How long do I have to appeal a Supplemental Notice or Bill?

A: You have 60 days from the date of the notice or bill to file an appeal with your county's Assessment Appeals Board.

Q: How can Paramount Property Tax Appeal help me?

A: We can review your Supplemental Notice or Bill, guide you through the appeal process, and represent you at the appeal hearing to ensure that your property taxes are fair and accurate.

.png)

.png?width=170&height=64&name=Logo%20320x120(2).png)